2602 · Is there a place in k1Recapture amounts from Form 4797, Part IV should be entered in the input area for the form on which the deduction was taken originally conflicting entry suggestions for 4797 sale of partnership rental real estateForm 4797 Sale of Business Property Force to Part II To enter a loss for the sale of business property not entered in TaxAct® as an asset for depreciation From within your TaxAct return (Online or Desktop), click Federal On smaller devices, click the menu icon in the upper lefthand corner, then select Federal;How do I associate my 1099MISC or 1099NEC with my Schedule C?

Solved Where Do I Report In Form 4797 Abandonment Of Leas Intuit Accountants Community

4797 form instructions

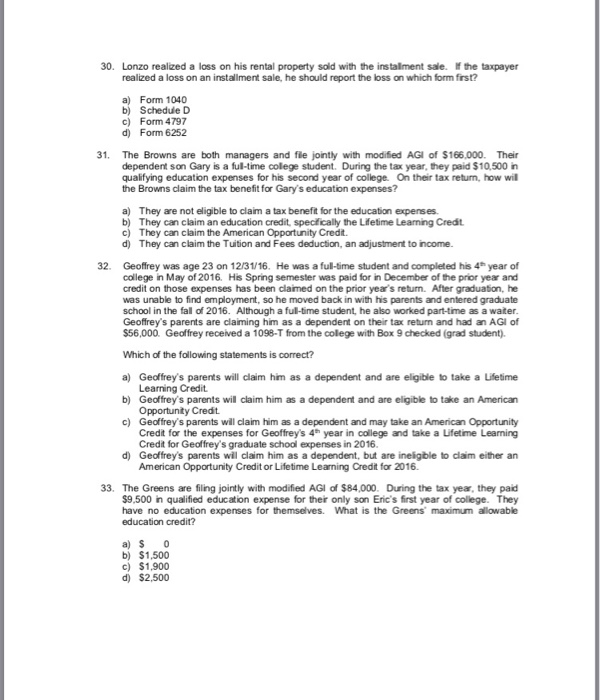

4797 form instructions- · If you sold businessuse property during the year, you had a gain or a loss on the sale Complete and file Form 4797 Sale of Business Property Businessuse property includes Rental property, like an apartment or a house; · The following diagnostic is generated;

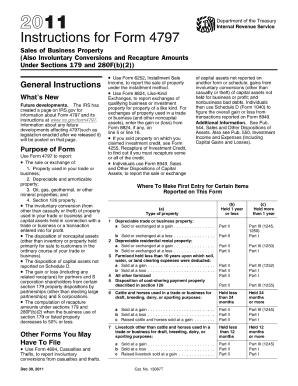

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

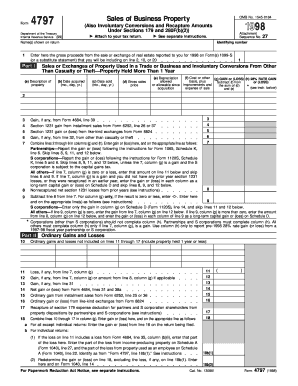

Form 4797 Sales of Business Property;Form 4797 Sales of Business Property « Previous 1 Next » Get Adobe ® ReaderFORM 4797 1999 Income Tax School Form 4797 is used primarily to report gains and losses from the disposition of businessuse assets, gains, and losses from certain involuntary conversions and recapture amounts under IRC §§179 and 280F(b)(2) Generally, reporting on Form 4797 is advantageous to the taxpayer because 1

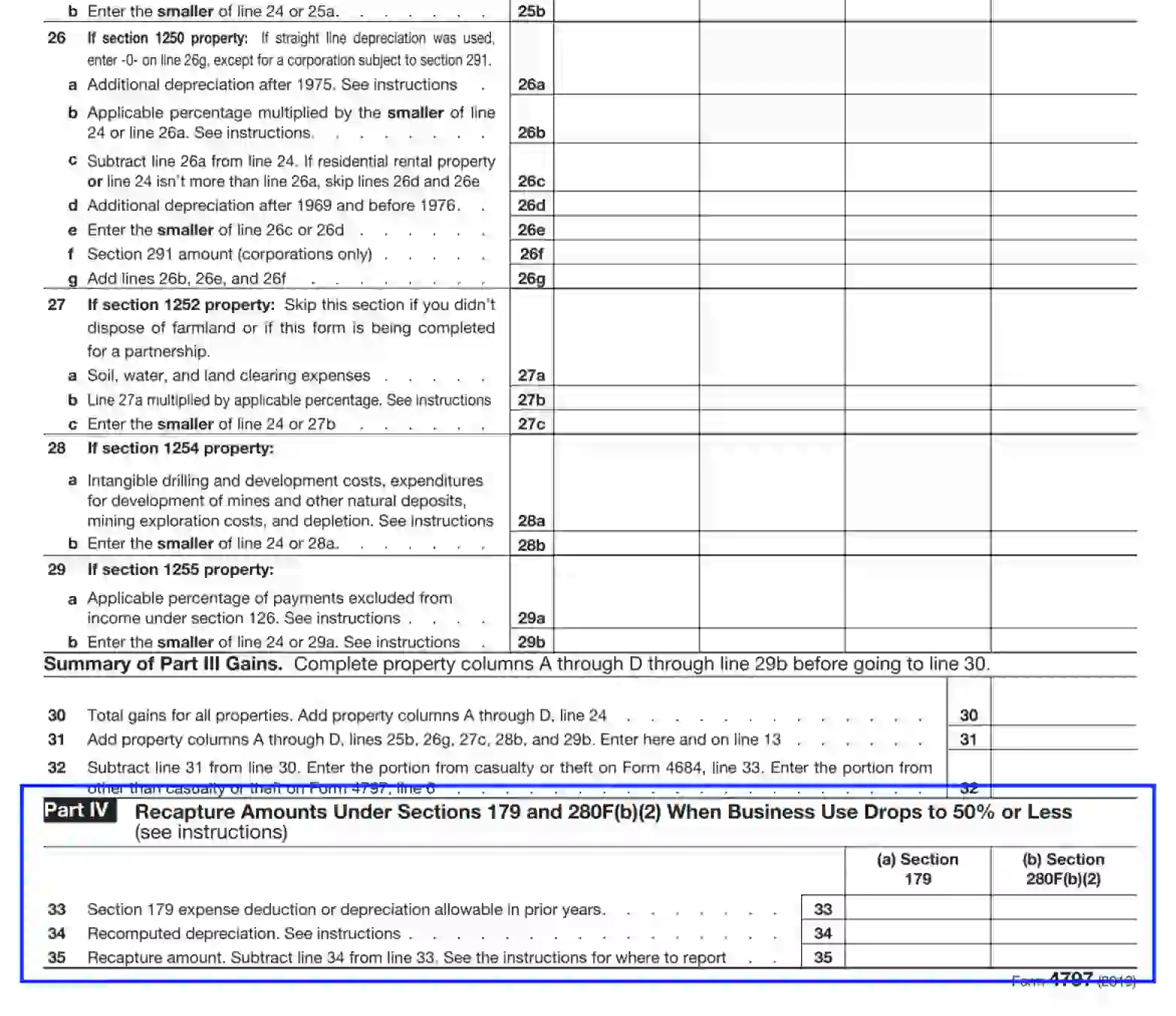

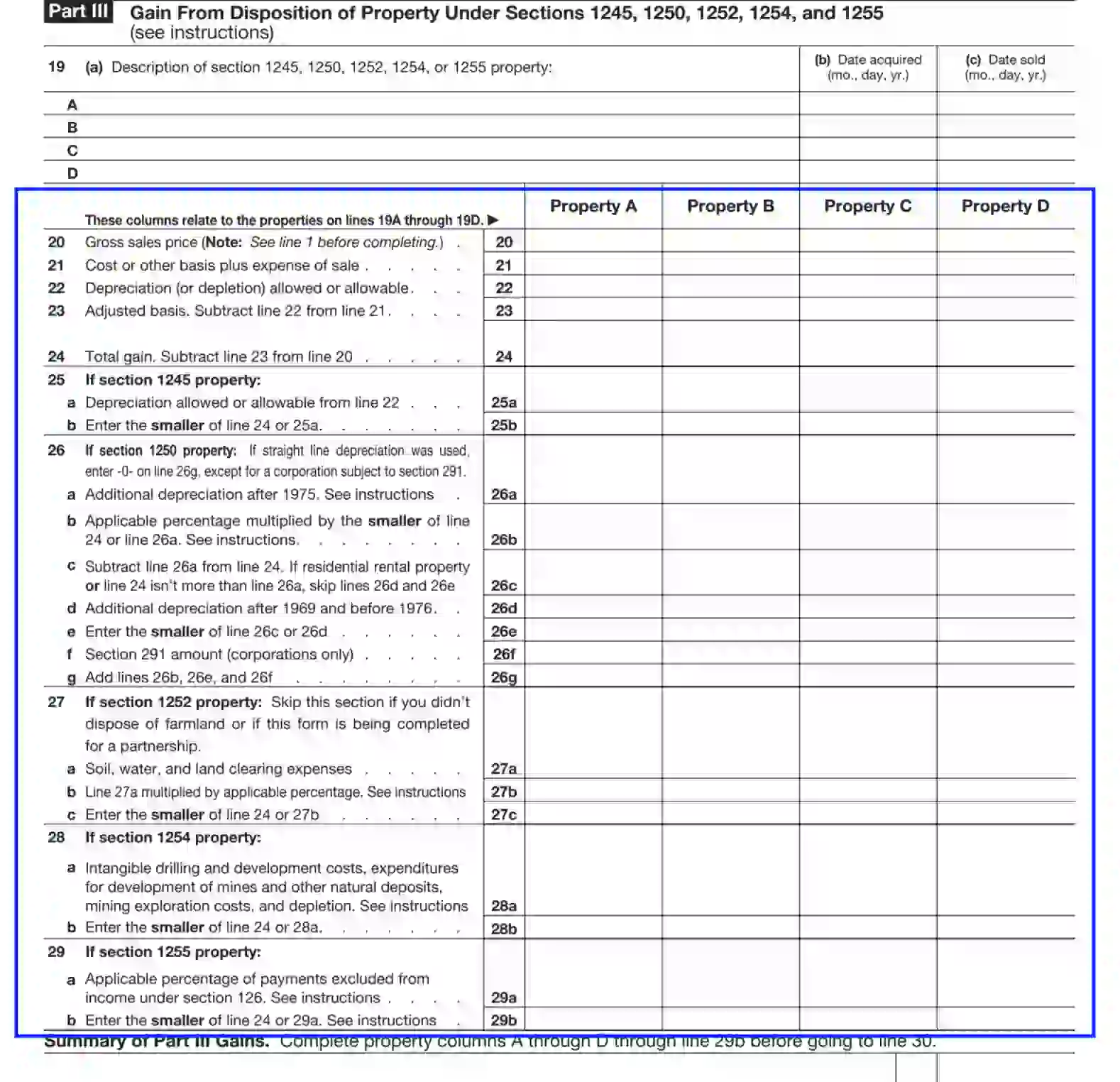

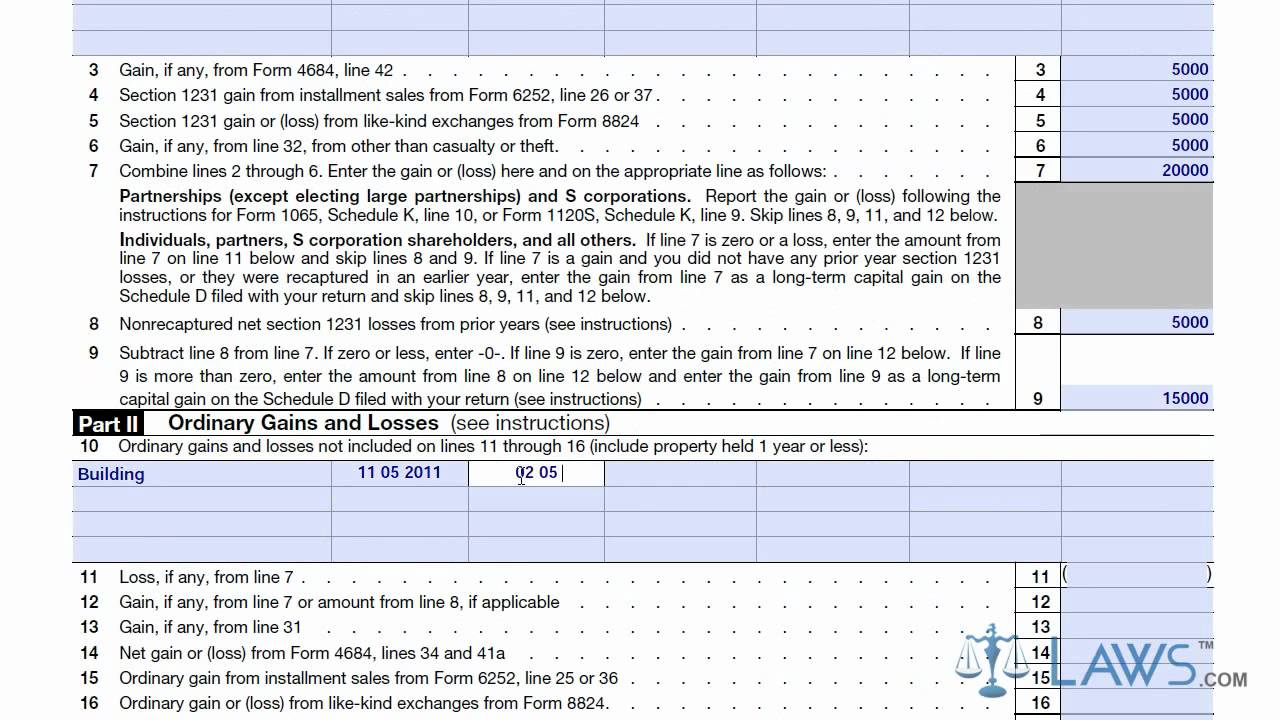

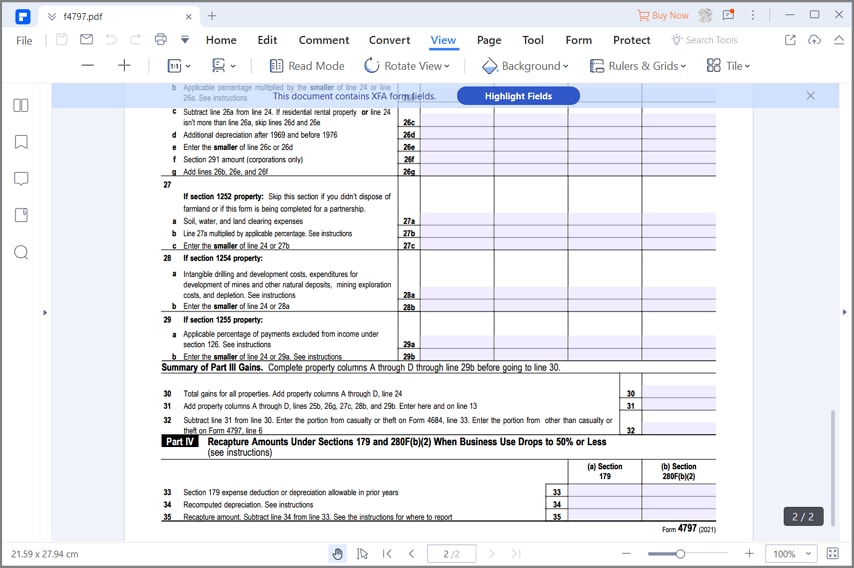

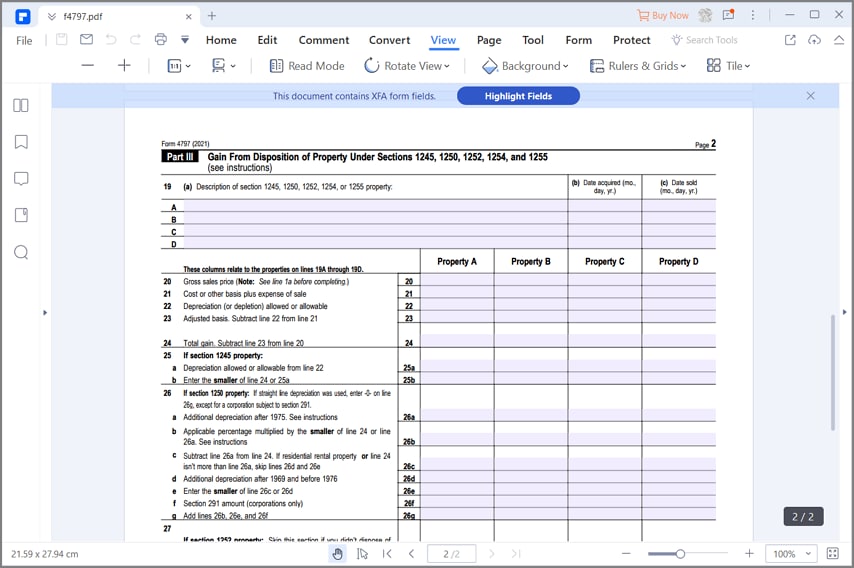

Vehicles or equipment that you both4797 Use Part III of Form 4797 to figure the amount of ordinary income recapture The recapture amount is included on line 31 (and line 13) of Form 4797 See the Instructions for Form 4797, Part III If the total gain for the depreciable property is more than the recapture amount, the excess is reported on Form 49 On Form 49,Do you have sales of stocks, bonds, or other personal property to enter?

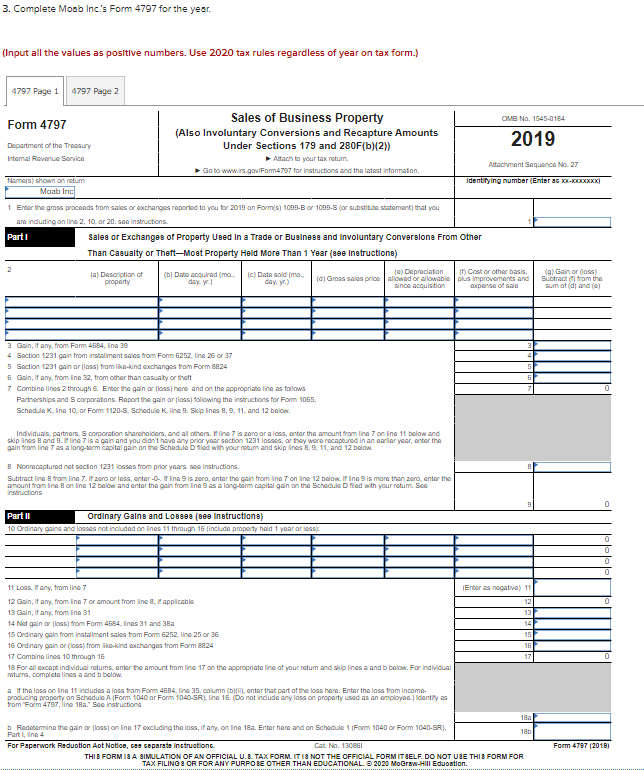

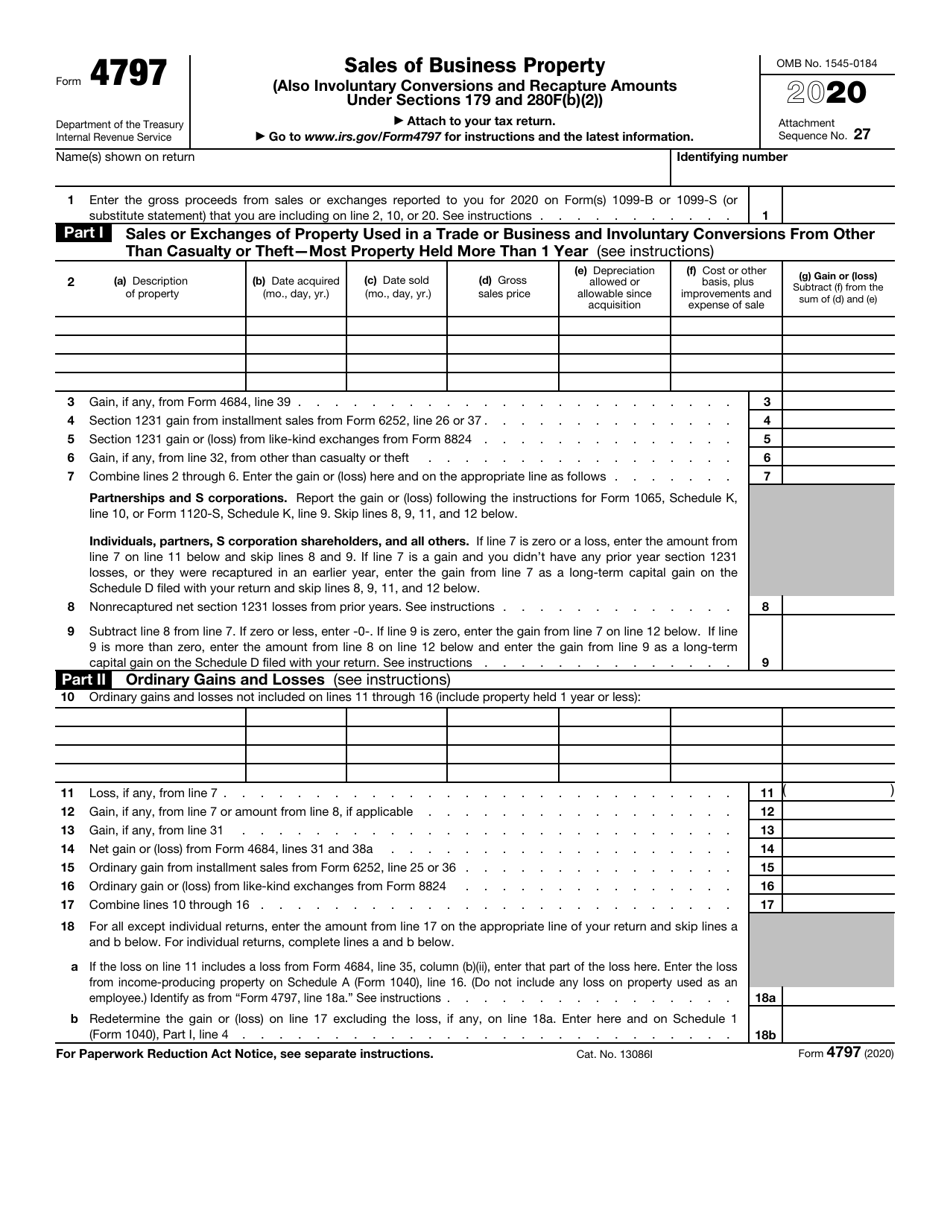

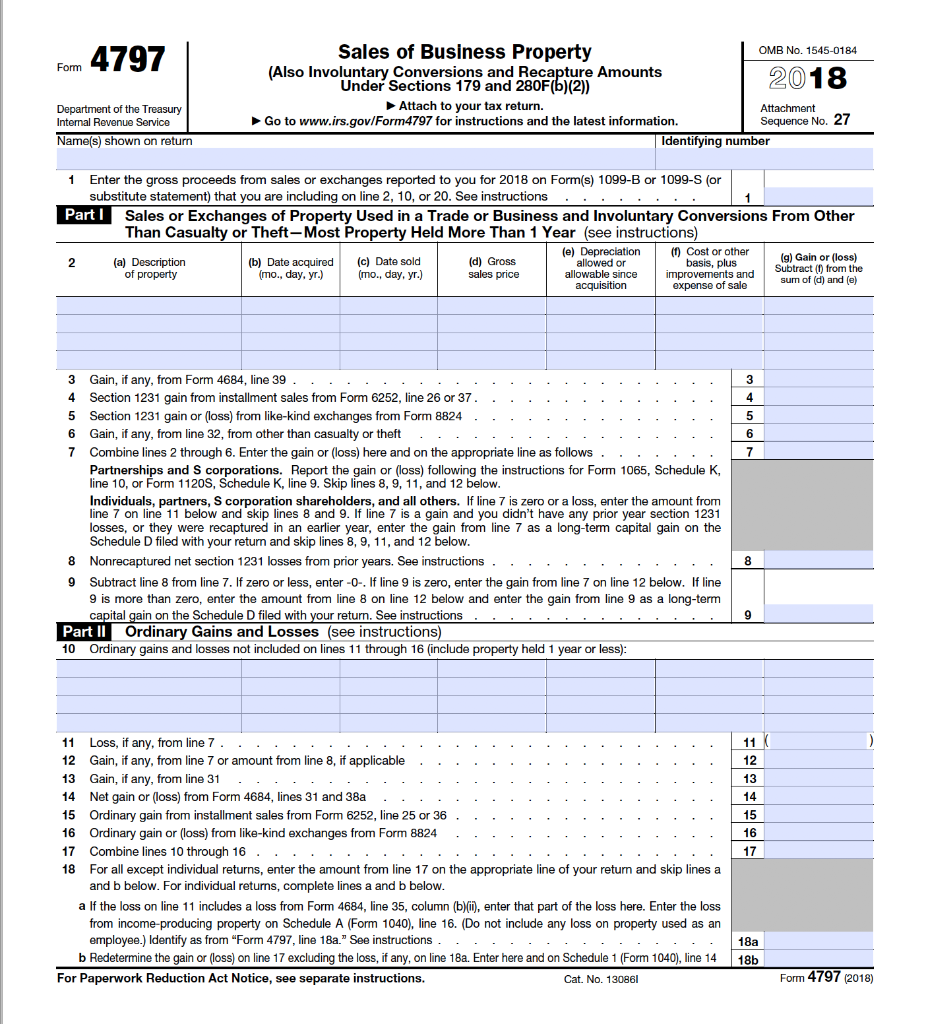

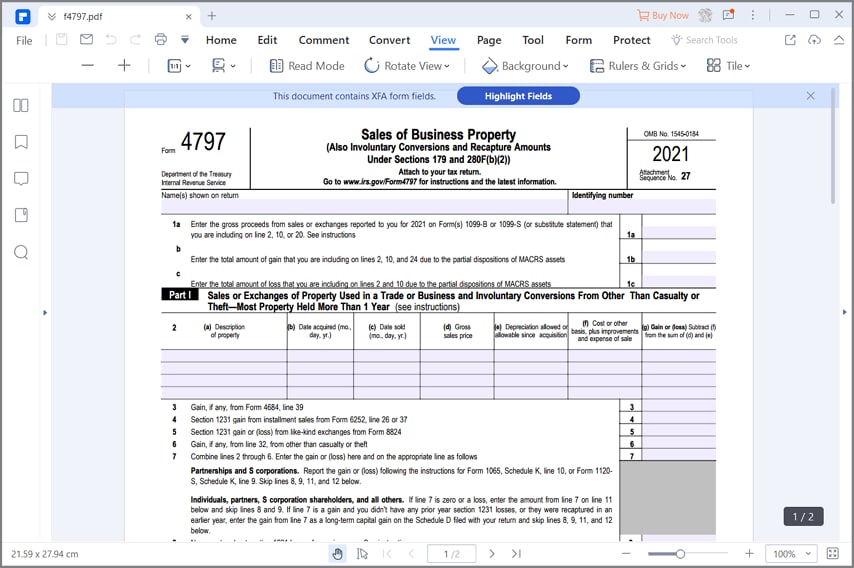

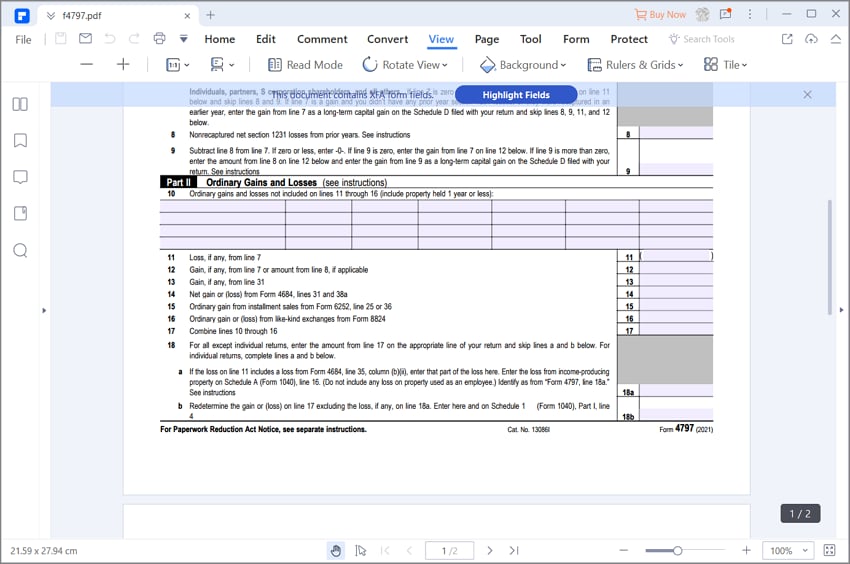

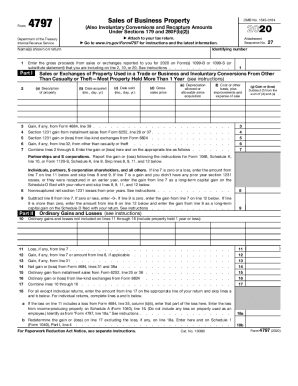

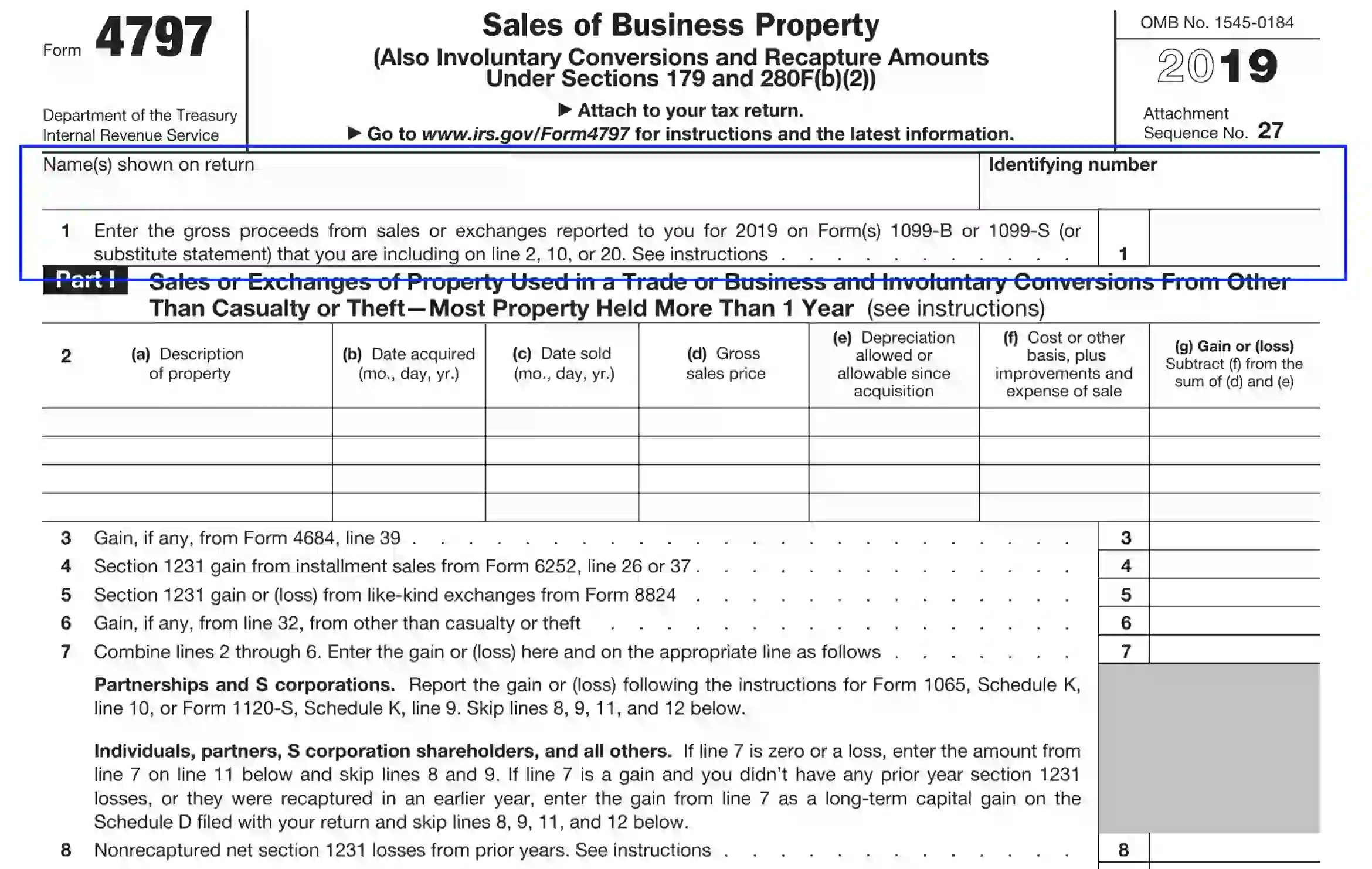

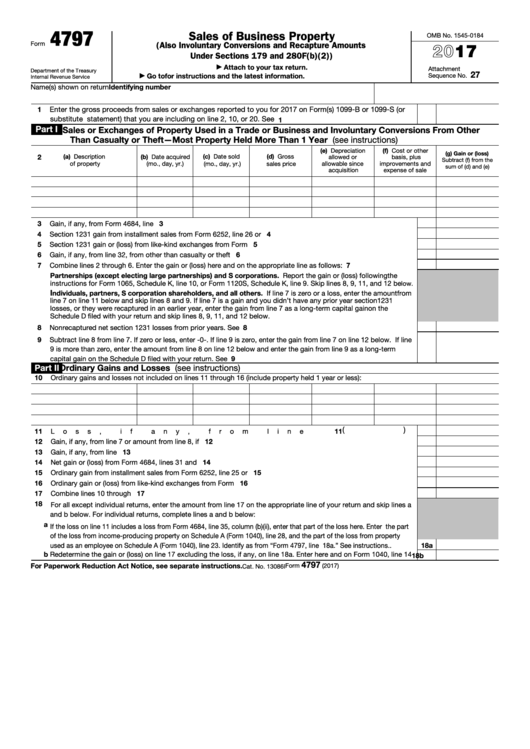

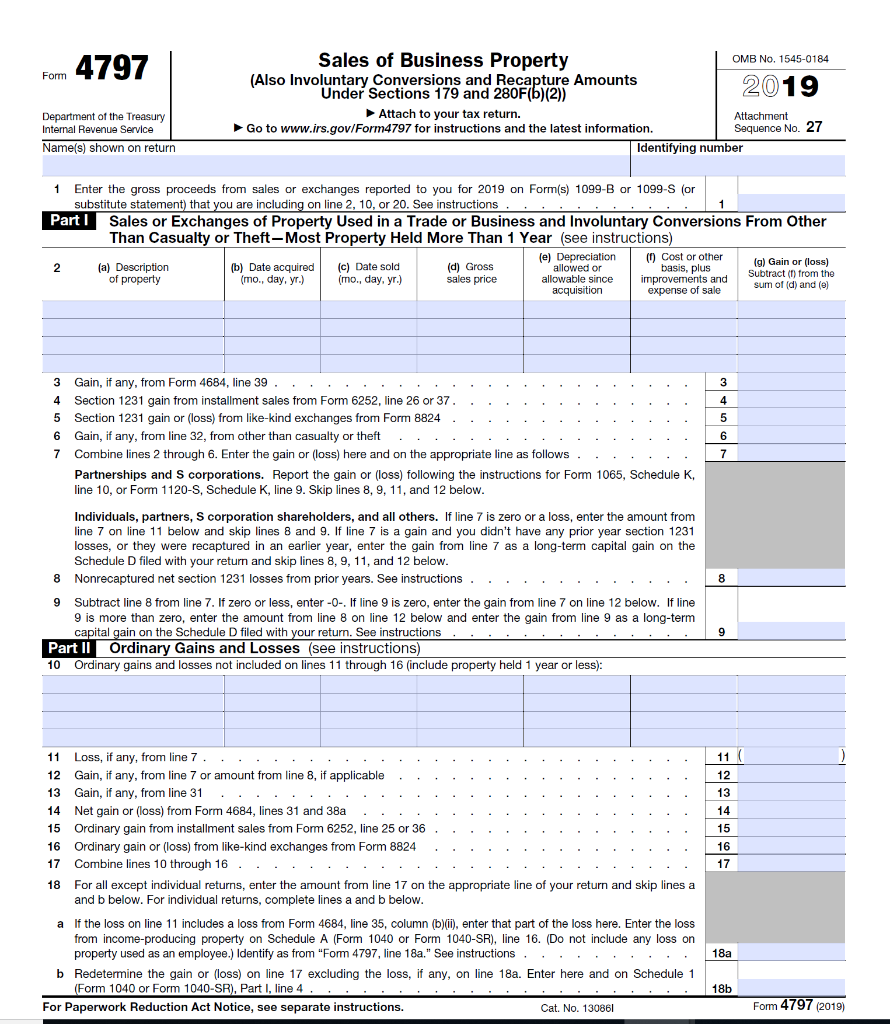

Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No 19 Attachment Sequence No 27 Name(s) shown on return1504 · Form 4797 to report current sale of sec 1231 property with a nonrecaptured net sec 1231 loss from 19 form 4797 Form 4797 Depreciation Allowed or taken since acquisitionForm 4797 A form one files with the IRS to report the profits (or losses ) from the sale or exchange of an asset For example, if a company sells the equipment from one of its factories, it reports the results of the sale on Form 4797

Schedule E Disposition Of Rental Property

Form 4797 Sales Of Business Property

Form 4797 Sale of Business Property Force to Part II If you have not entered an asset for depreciation, the screen to enter a loss on Part II of IRS Form 4797 will not appear If you need to enter a loss on Form 4797 Part II, use the instructions below to add the necessary informationInstructions for Form MI4797 File this form if you have gains from the disposition of property acquired prior to October 1, 1967, or if you have gains or losses from property subject to allocation and apportionment provisions Lines not listed are explained on the form Report all amounts in Line 3 Enter in column D any gain from US FormName on Form 1040N or Form 1041N Social Security Number Part II — Determine if a NonEmployee Qualifies to Make the Election Part III — Determine if the Capital Stock Qualifies Part IV — Sales and Other Dispositions of Capital Assets • Part IV is only required if you have not attached either Federal Forms 49 or 6252

Solved Where Do I Report In Form 4797 Abandonment Of Leas Intuit Accountants Community

Irs Form 4797 Fill Out Printable Pdf Forms Online

And Form 4797 Riley Adams, CPA, Senior Financial Analyst Google riley@youngandtheinvestedcom Michael Plaks, Enrolled Agent REI Tax Firm service@michaelplakscom Dawn Polin, CPA, Senior Manager Cherry Bekaert dpolin@cbhcomTransactions are entered under Enter/Edit 4797 Transactions There are a few additional lines on the form, andForm 4797 is a tax form distributed by the Internal Revenue Service (IRS) Form 4797 is used to report gains made from the sale or exchange of business property, including property used to

/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

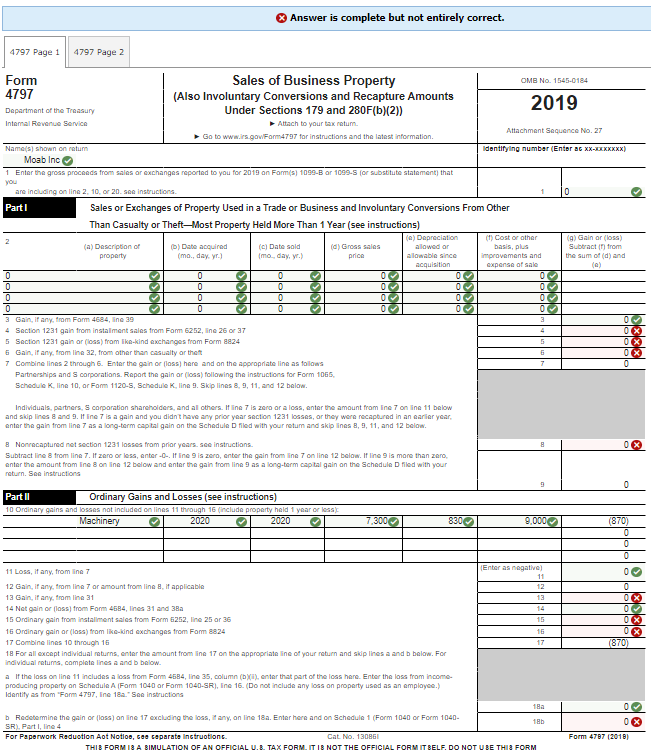

3 Complete Moab Inc S Form 4797 For The Year I Chegg Com

Next, go to the 4797 screen, enter the sale, and select the 1099S transaction box If the property does not appear on a 4562 screen, complete screen 4797, selecting the 1099S transaction option For more information, see the Instructions for Form 1099S4797 Use Part III of Form 4797 to figure the amount of ordinary income recapture The recapture amount is included on line 31 (and line 13) of Form 4797 See the Instructions for Form 4797, Part III If the total gain for the depreciable property is more than the recapture amount, the excess is reported on Form 49 On Form 49,Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No Attachment Sequence No 27 Name(s) shown on return

How To Report The Sale Of A U S Rental Property Madan Ca

Solved Where Do I Report In Form 4797 Abandonment Of Leas Intuit Accountants Community

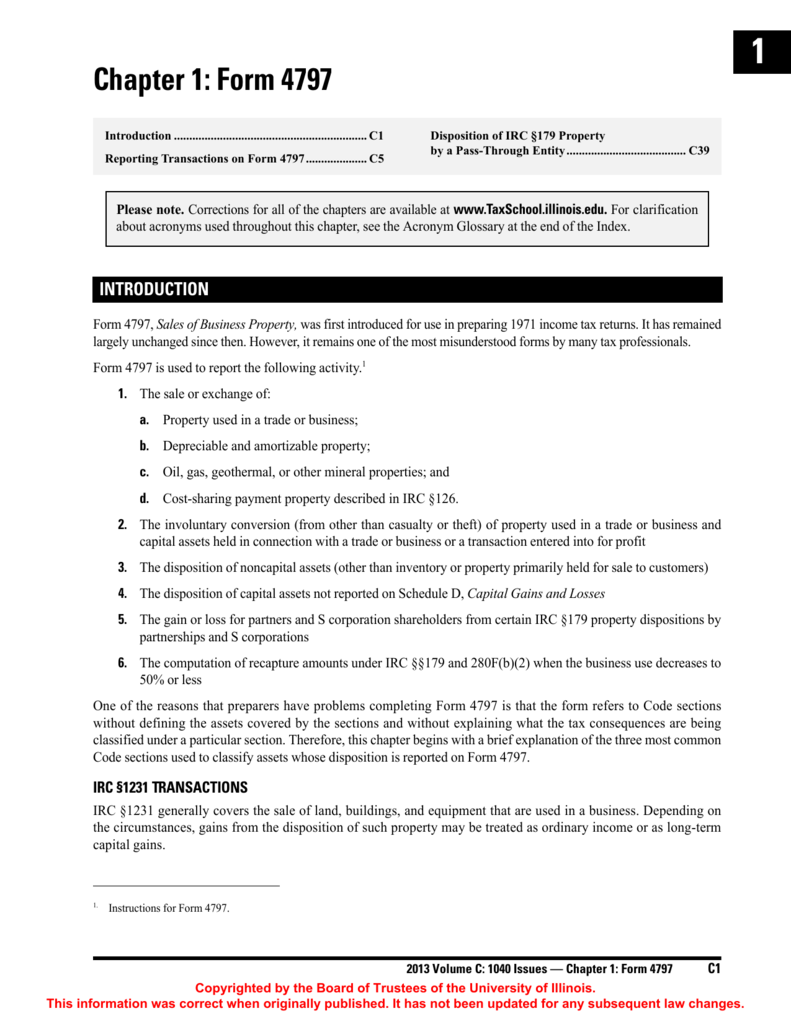

Then, on Form 4797, line 2, report the qualified section 1231 gains you are electing to defer as a result of an investment into a QOF within 180 days of the date sold If you are reporting the sale directly on Form 4797, line 2, use the line directly below the line on which you reported the sale08 Workbook 08 Chapter 3 Form 4797 77 3 Chapter 3 Form 4797 Form 4797, Sales of Business Property, was first introduced for use in preparing the 1971 income tax return It has remained virtually unchanged since then However, it remains one of the most misunderstood formsThe part of your home you used as a home office if it's not connected to the house;

Oklahoma Tax Commission Begins Scrutinizing Federal Form 4797 Sales Of Business Property Bkd Llp

Irs Form 4797 Fill Out Printable Pdf Forms Online

Form 4797 A form one files with the IRS to report the profits (or losses) from the sale or exchange of an asset For example, if a company sells the equipment from one of its factories, it reports the results of the sale on Form 4797 Farlex Financial Dictionary © 12This entry is used to tie the sales price and the recapture type to Form 4797 No entries for depreciation need to be entered on worksheets, unless overrides are needed Property Code entered in line 4 is a required entry, as this designates where the information flows on Form 4797To enter the sale of business property From the Main Menu of the Tax Return (Form 1040) select Income Menu Other Gains/Loss (4797/84) Form 4797 Sales of Business Property Enter/Edit 4797 Transactions Select 'New' or doubleclick the entry you wish to 'Edit'

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Form 4797 (1976) Author TF&P Subject Supplemental Schedule of Gains and Losses Created Date 3/17/09 AMDo rental properties qualify for the Qualified Business Income Deduction (QBID) ?Form 4797 Proper Preparation of Form 4797 and Discussion of §1245 Recapture, §179 Recapture, Unrecaptured §1250 Gain, and §1231 Gain Recorded 10/22/

Form 4797 Sale Of Assets The Good The Bad And The Ugly

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

1007 · It will not flow to Form 4797 or Form 49 to be recognized as a gain in the current tax year The deferred gain will proforma every year until it's sold or needs to be recognized Question I deferred a gain previously by investing in a QOF and now I want to recognize the gainAccording to the IRS Instructions for Form 4797, you should file this Form with your return if you sold or exchanged anyFixed Assets CS enables you to print a submittable Form 4797 (Sales of Business Property) for the active client To open this dialog, click the Print button or choose File > Print From the Print dialog, click the Forms tab and select Form 4797 Then, click the Options button and click the Form 4797

Form Irs Instruction 4797 Fill Online Printable Fillable Blank Pdffiller

How To Fill Out Irs Form 4797 Real Estate Tax Strategy Wealthfit

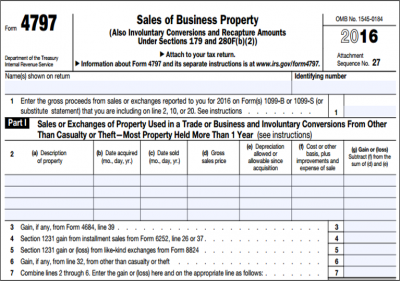

Instructions Tips More Information Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/downloadInstructions for Form 4797, Sales of Business Property 16 Form 4797 Sales of Business Property 15 Inst 4797 Instructions for Form 4797, Sales of Business Property 15 Form 4797 Sales of Business Property 14 Inst 4797 Instructions for Form 4797, Sales of Business PropertyRecapture amounts from Form 4797, Part IV should be entered in the input area for the form or schedule on which the deduction was taken originally (ref #) Solution Description This diagnostic is generated because input fields on Screen 171, Section 4

Publication 225 Farmer S Tax Guide Chapter Sample Return Preparing The Return

Section 1231 And Depreciation Recapture Use This I Chegg Com

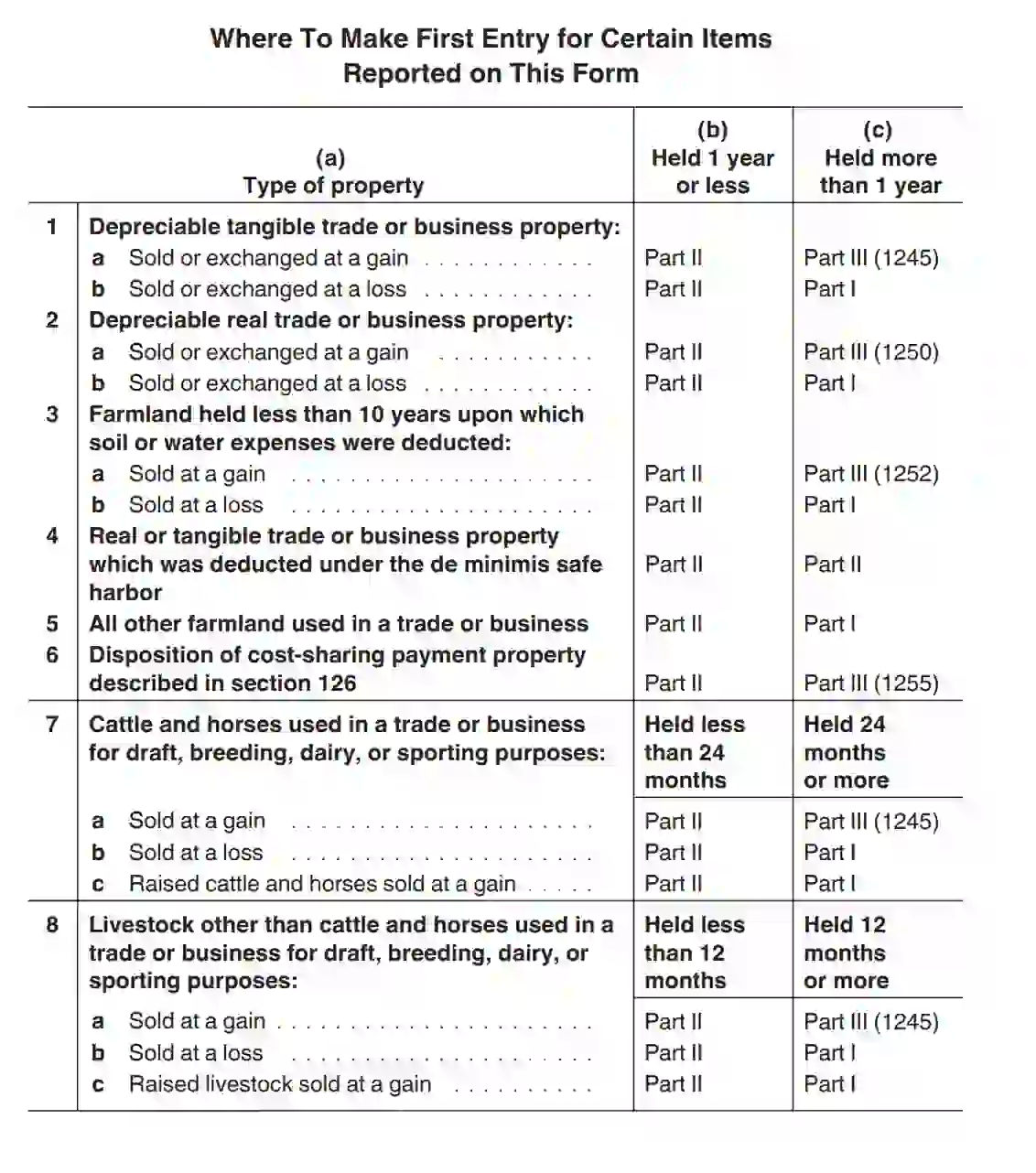

The disposition of each type of property is reported separately in the appropriate part of Form 4797 Sales of Business Property (for example, for property held more than one year, report the sale of a building in Part III and land in Part I) For more information, refer to the IRS Instructions for Form 47971500 · Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets About Form 4797, Sales of Business Property Internal Revenue ServiceWhat is Form 4797, Sales of Business Property?

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Form 4797 Ins Outs Of Reporting The Sale Of Trade Or Business Property

Form 4797 A form one files with the IRS to report the profits (or losses) from the sale or exchange of an asset For example, if a company sells the equipment from one of its factories, it reports the results of the sale on Form 4797 Farlex Financial Dictionary © 12Answer Per the Form 4797 instructions, S Corporations that dispose of property for which a section 179 expense deduction was previously passed through to the shareholder, do not complete Form 4797, 4684, 6252, or 84 with respect to these types of dispositionsQuestion Why is a Schedule M1 adjustment for Form 4797 being generated for the sale of section 179 assets?

Line 31 On Form 4797 Sale Of Assets

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

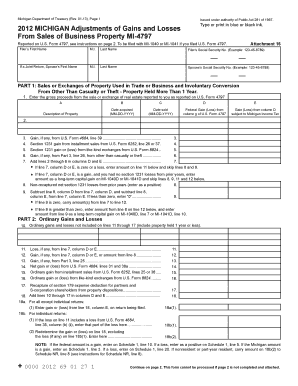

Generally, Form 4797 is used to report the sale of a business This may include your home that was converted into a rental property or any real property used for trade or business Who Can File Form 4797 Sales of Business Property?From Sales of Business Property MI4797 Report all amounts in whole dollars Reported on US Form 4797 To be filed with Form MI1040 or MI1041, see instructions Attachment 16 Filer's Name Shown on Tax Return Identifying Number PART 1 Sales or Exchanges of Property Used in Trade or Business and Involuntary ConversionInst 4797 Instructions for Form 4797, Sales of Business Property 10// Form 4797 Sales of Business Property « Previous 1 Next » Get Adobe ® Reader

Fillable Online Sale Of Exchange Property Form 4797 Fax Email Print Pdffiller

Form 4797 Depreciation Guru

Form 4797 Sales of Business Property Form 4797 Sales of Business Property 19 Form 4797Product Number Title Revision Date;Form 4797 Part I – most property held more than 1 year Longterm assets sold at a loss Nondepreciable longterm assets sold at a gain Income from Part III, line 32 Nonrecapture net §1231 losses from prior years 6

Form 4797 Sales Of Business Property

Chapter 1 Form 4797 University Of Illinois Tax School

· But the 4797 does not go to Form 49 But the instructions to 4797 say to use 49 to report the deferred gain But then the instructions for 49 say that 4797 gains go directly to Sch D For now, we've added another line item on page 1 of the 4797 showing a loss for the amount of the deferred gain that was invested,Form 4797 Sales of Business Property Inst 4797 Instructions for Form 4797, Sales of Business Property « Previous 1 Next » Get Adobe ® ReaderForm 4797 Date Acquired and Date Sold or Disposed are entered on Form 4797 Input Sheet, Form 4797 Detail Schedule, or through Fixed Assets Disposition Tab If entering through Fixed Assets, the only Acceptable Date Acquired and Date of Disposition entries are actual dates

Irs Form 4797 Fill Out Printable Pdf Forms Online

/32082667638_810297ef22_k-cabd90e96d994717af9624c12dc728bc.jpg)

Form 4797 Sales Of Business Property Definition

Form 4797 Sales of Business Property Inst 4797 Instructions for Form 4797, Sales of Business PropertyForm 4797 A form one files with the IRS to report the profits (or losses ) from the sale or exchange of an asset For example, if a company sells the equipment from one of its factories, it reports the results of the sale on Form 4797

How To Report The Sale Of A U S Rental Property Madan Ca

Irs Form 4797 Instructions Fill Online Printable Fillable Blank Pdffiller

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Form 4797 Depreciation Guru

Group Sale Calculations

Webinar Form 4797 Sale Of A Business Asset Center For Agricultural Law And Taxation

Understanding Irs Form 4797 Balboa Capital

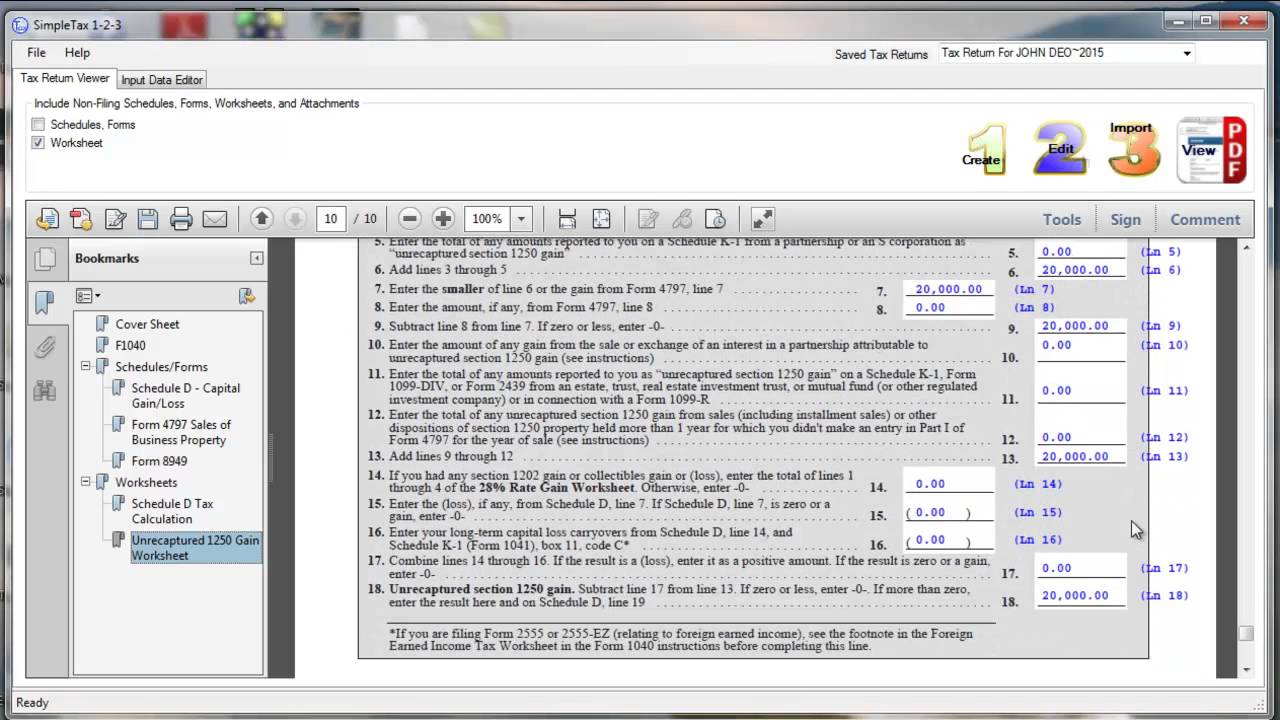

Simpletax Form 4797 Youtube

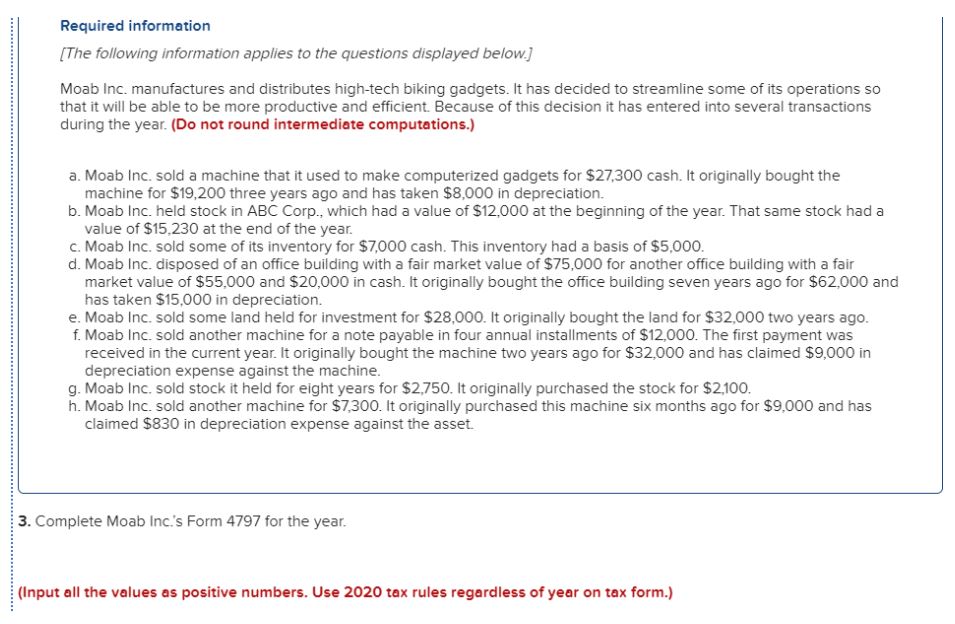

Solved Moab Inc Manufactures And Distributes High Tech B Chegg Com

Form 4797 Depreciation Allowed Or Taken Since Ac Intuit Accountants Community

Fillable Online Michigan Mi 4797 Form Fax Email Print Pdffiller

Form 4797 What Is It Gains On Sale Of Business Property

Irs Form 4797 Guide For How To Fill In Irs Form 4797

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

4797 Instructions 21 Irs Forms Zrivo

Form 4797 Ins Outs Of Reporting The Sale Of Trade Or Business Property

Depreciation Forms 4562 4797 Youtube

Irs 4797 Form Pdffiller

Ira Tax Nuclear Bomb Fugitive Follow Up Question Mlps Message Board Posts

Dunphy Form 4797 Form 4797 Department Of The Treasury Internal Revenue Service 99 Sales Of Business Property Also Involuntary Conversions And Course Hero

What You Need To Know About Form 4797 Estate Tax Capital Gains Tax Real Estate Investing

Gains And Losses Capital Gains And Wash Sale Calculate Tax Software For Schedule D Neutral Trend Trademax

Answered 3 Complete Moab Inc S Form 4797 For Bartleby

Form 4797 Group Project Group 3 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 14 Also Course Hero

Irs Form 4797 Fill Out Printable Pdf Forms Online

Fillable Form 4797 Sales Of Business Property 17 Printable Pdf Download

Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Free Download

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Actg068a Solution Hw 3 18 Form 4797 Pdf Form 4797 Sales Of Business Property Omb No 1545 0184 Also Involuntary Conversions And Recapture Amounts Course Hero

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Irs Form 4797 Guide For How To Fill In Irs Form 4797

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Fill Free Fillable F4797 Accessible 19 Form 4797 Pdf Form

Publication 925 Passive Activity And At Risk Rules Comprehensive Example

Form 4797 Sales Of Business Property

Form 4797 Sales Of Business Property 14 Free Download

Solved Required Information The Following Information Ap Chegg Com

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Re How Do I Find Form 4797 Part Iii Lines 19 24

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

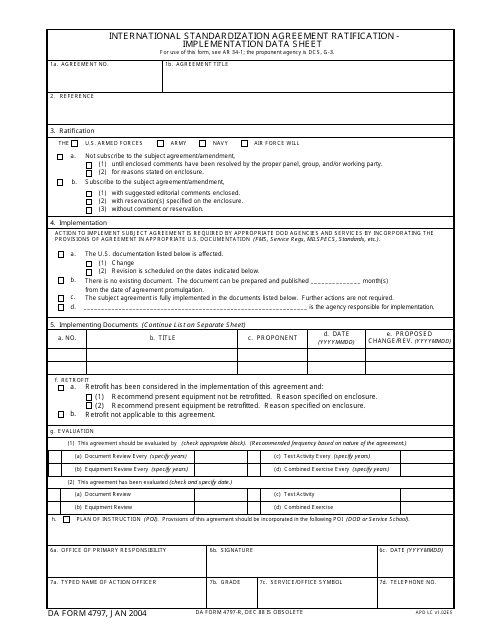

Da Form 4797 Download Fillable Pdf Or Fill Online International Standardization Agreement Ratification Implementation Data Sheet Templateroller

How To Fill Out Form 4797 Rental Property Property Walls

Form 4797 How And When To Fill It Out Depreciation Guru

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders